Lifetime Gift Tax Exclusion 2025. The annual gift tax exclusion. The us internal revenue service (irs) has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes. The us internal revenue service (irs) has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

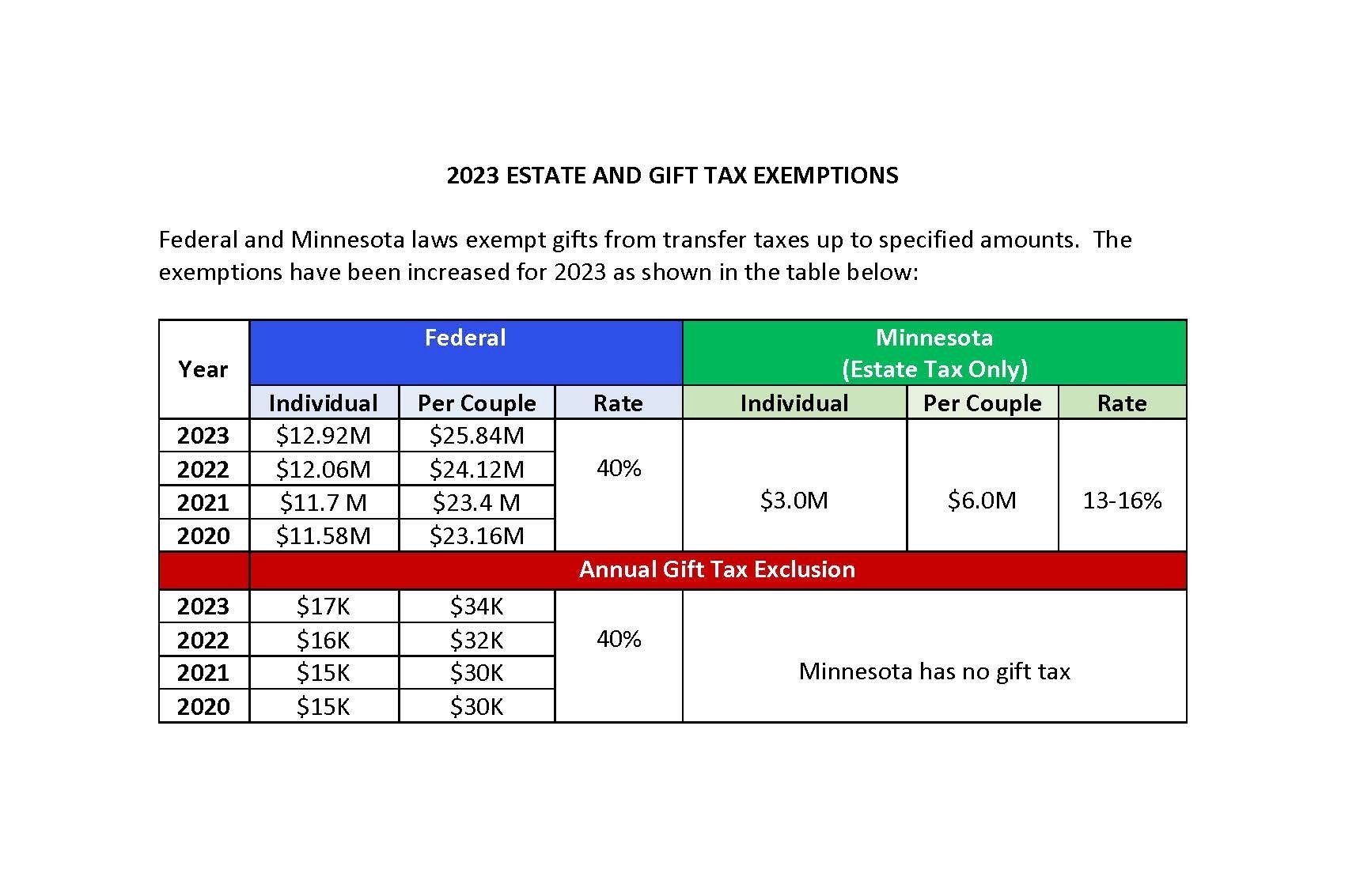

Annual Gifting For 2025 Image to u, The lifetime exemption from the federal gift and estate tax will rise to $13.61 million per person (from $12.92 million per person in 2025).

Irs Annual Gift Tax Exclusion 2025 Maris Shandee, These payments don’t count against the annual exclusion or lifetime exemption and do not trigger gift tax consequences.

Lifetime Gift Tax Exclusion 2025 Cami Trudie, The lifetime exemption from the federal gift and estate tax will rise to $13.61 million per person (from $12.92 million per person in 2025).

Lifetime Gift Tax Exclusion 2025 Gay Kathryne, Here's how the gift tax works, along with current rates and exemption amounts.

Lifetime Gift Tax Exclusion 2025 In India Angel Blondie, Here's how the gift tax works, along with current rates and exemption amounts.

Lifetime Gift Tax Exemption 2025 What You Need to Know Keystone, Looking forward to 2025, the irs recently announced that the annual gift tax exclusion will increase to $19,000 per individual, while the lifetime estate and gift tax exemption will rise.

.jpg)

2025 Lifetime Gift Tax Exclusion Amount Ashlie Karoline, Married couples can effectively double this amount to.