Maximum Charity Deduction 2025. This publication explains how individuals claim a deduction for charitable contributions. Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized.

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the. This publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations.

For the 2025 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and in 2025 that will increase to $13,850 for.

Tax deduction What items can a taxpayer deduct as a charitable, Most people know that donating to charity can help them save on their income taxes. Many people are looking for ways to reduce their tax burden.

2025 Updated SSS Contribution Rate Escape Manila, The maximum amount that can be deducted from their lsdba is £375,000. When you donate money to a qualifying public charity, you can deduct up to 60% of your income, alleviating your tax burden.

Video with MAXIMUM ADs for CHARITY 💤 (8h Lofi Playlist) YouTube, In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the. It also explains what kind of.

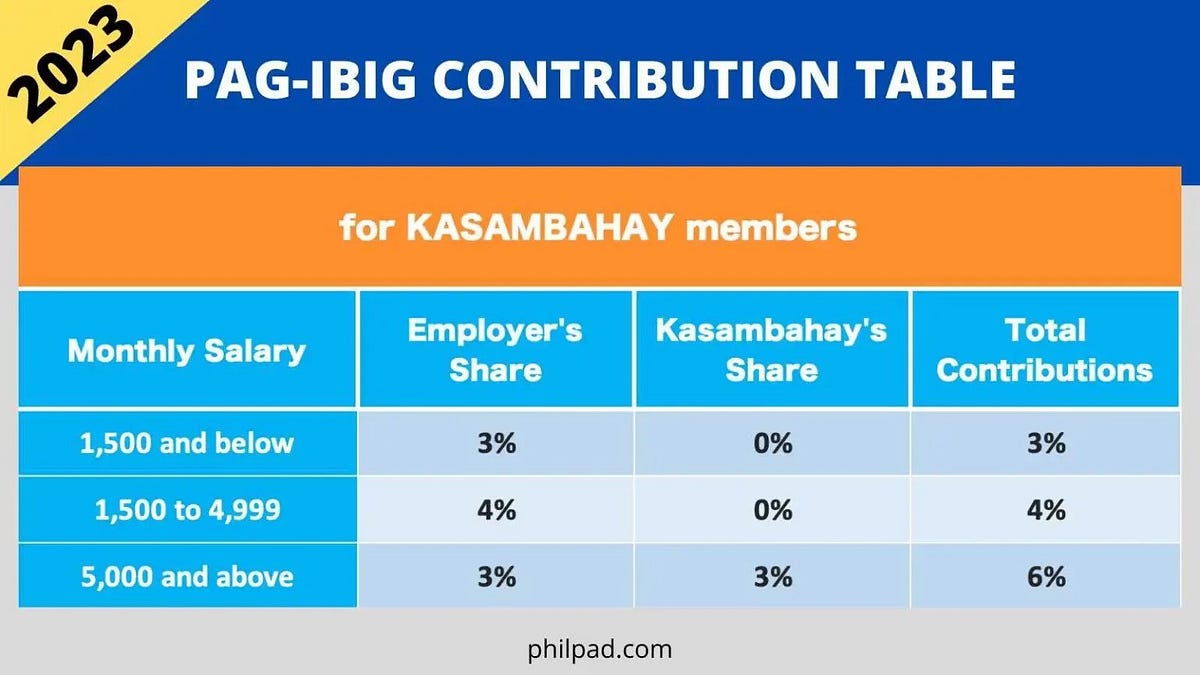

PagIBIG Contribution Table 2025 Compute HDMF Contributions Easily and, Charitable contributions are a type of personal. In 2025, the limit for this type of gift increased to $105,000 per year.

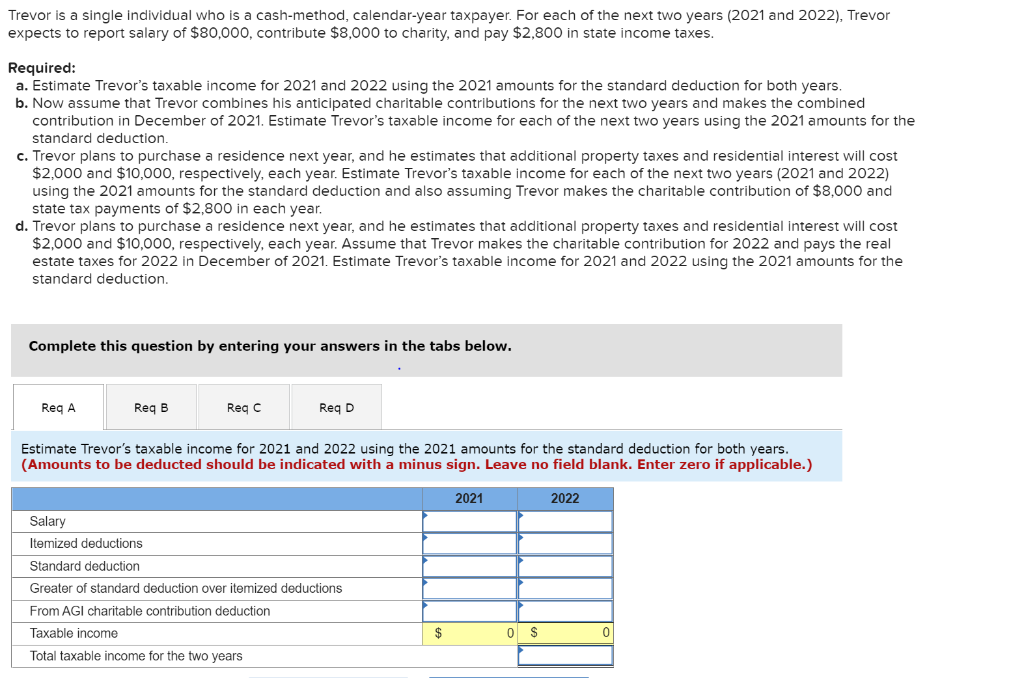

Solved Trevor is a single individual who is a cashmethod,, It can range from 50% to 100% of the donated sum,. This publication explains how individuals claim a deduction for charitable contributions.

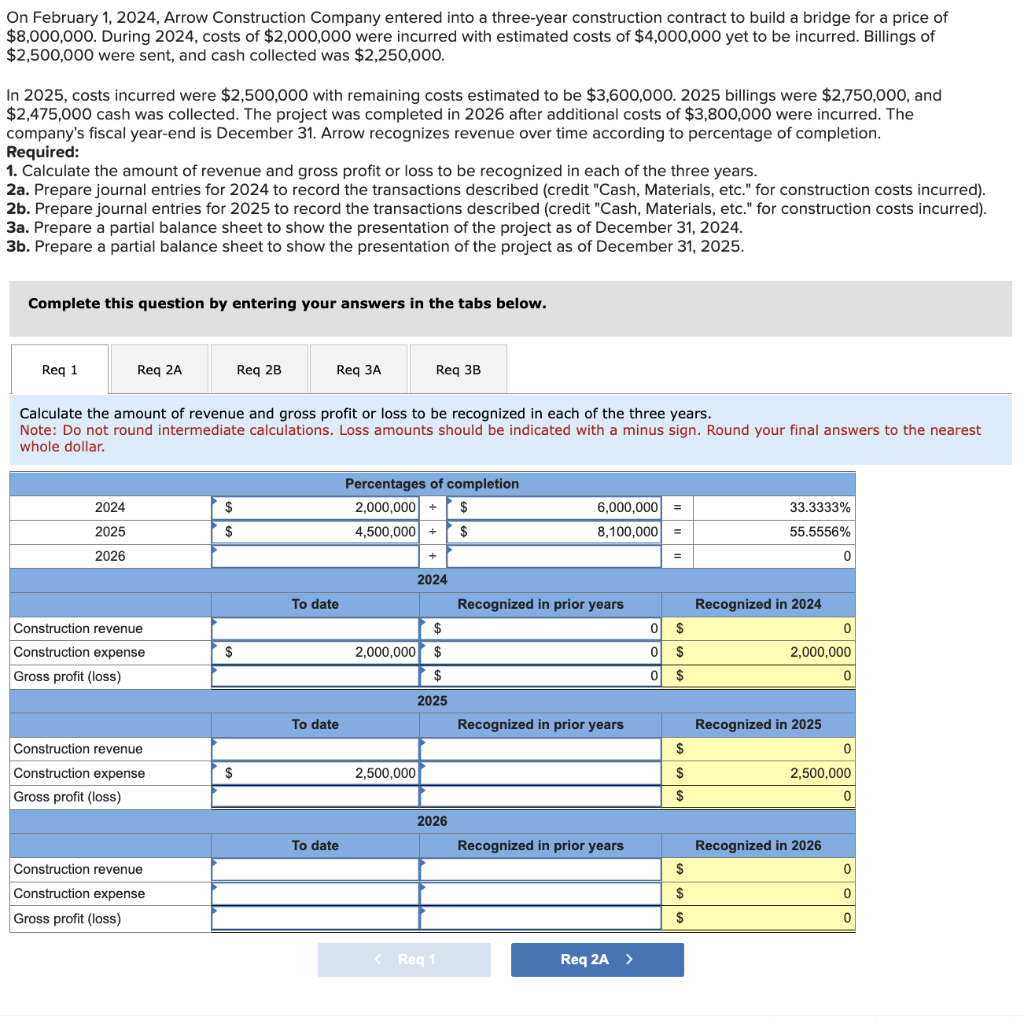

Solved On February 1, 2025, Arrow Construction Company, In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the. 1.section 80g allows taxpayers to claim deduction for donations to eligible fund, institution or trust, to encourage philanthropy.

Federal Standard Deduction 2025 Audrye Jacqueline, 1.section 80g allows taxpayers to claim deduction for donations to eligible fund, institution or trust, to encourage philanthropy. The donor receives benefits having a fair market value of $132 or 2% of the payment, whichever is.

Is the Charitable Deduction Worth Keeping? Niskanen Center, For single taxpayers and married. Here’s what you need to know.

Revisiting the CARES Act Charity Deduction with Jeff Levine YouTube, This publication explains how individuals claim a deduction for charitable contributions. The standard deduction is a fixed amount that all taxpayers are eligible to deduct from their taxable income, regardless of their expenses during the tax year.

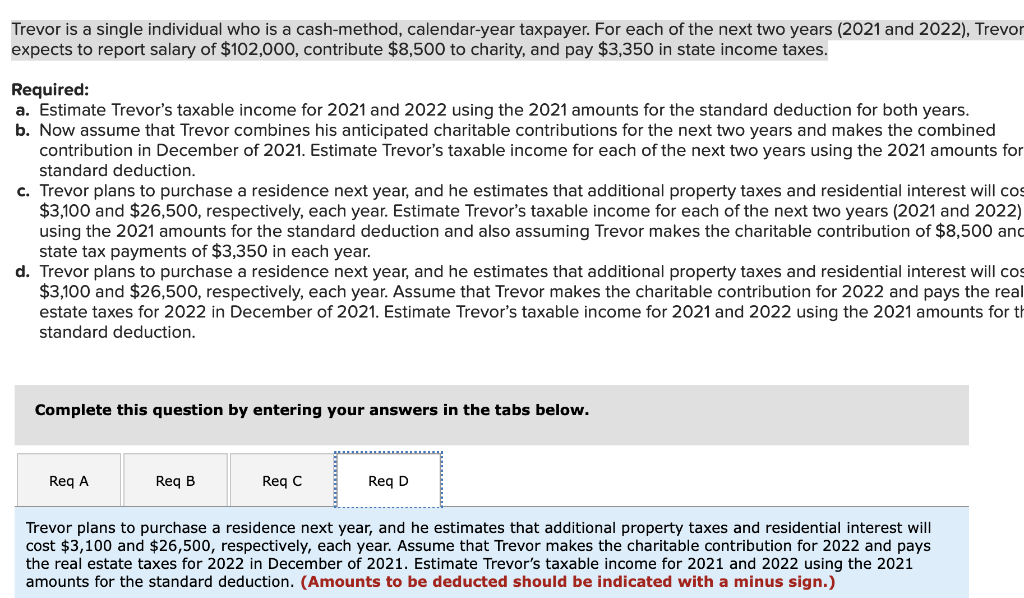

Solved Trevor is a single individual who is a cashmethod,, 16, 2025 — the internal revenue service today reminded individual retirement arrangement (ira) owners age 70½ or over that they can transfer up to. Most people know that donating to charity can help them save on their income taxes.

Section 80g of the income tax act provides for a deduction for donations made to certain charitable institutions or funds.